Board-Walk Empire: It’s Not Personal. It’s Just Fiduciary

Share This Email:

CEO, Veritas Executive Compensation Consultants

Prologue: Welcome to the Empire

Welcome to Board-Walk Empire—a candid look behind the curtain of modern governance, where performance meets politics, judgment meets pressure, and every boardroom becomes a stage for navigating risk, reputation, and responsibility.

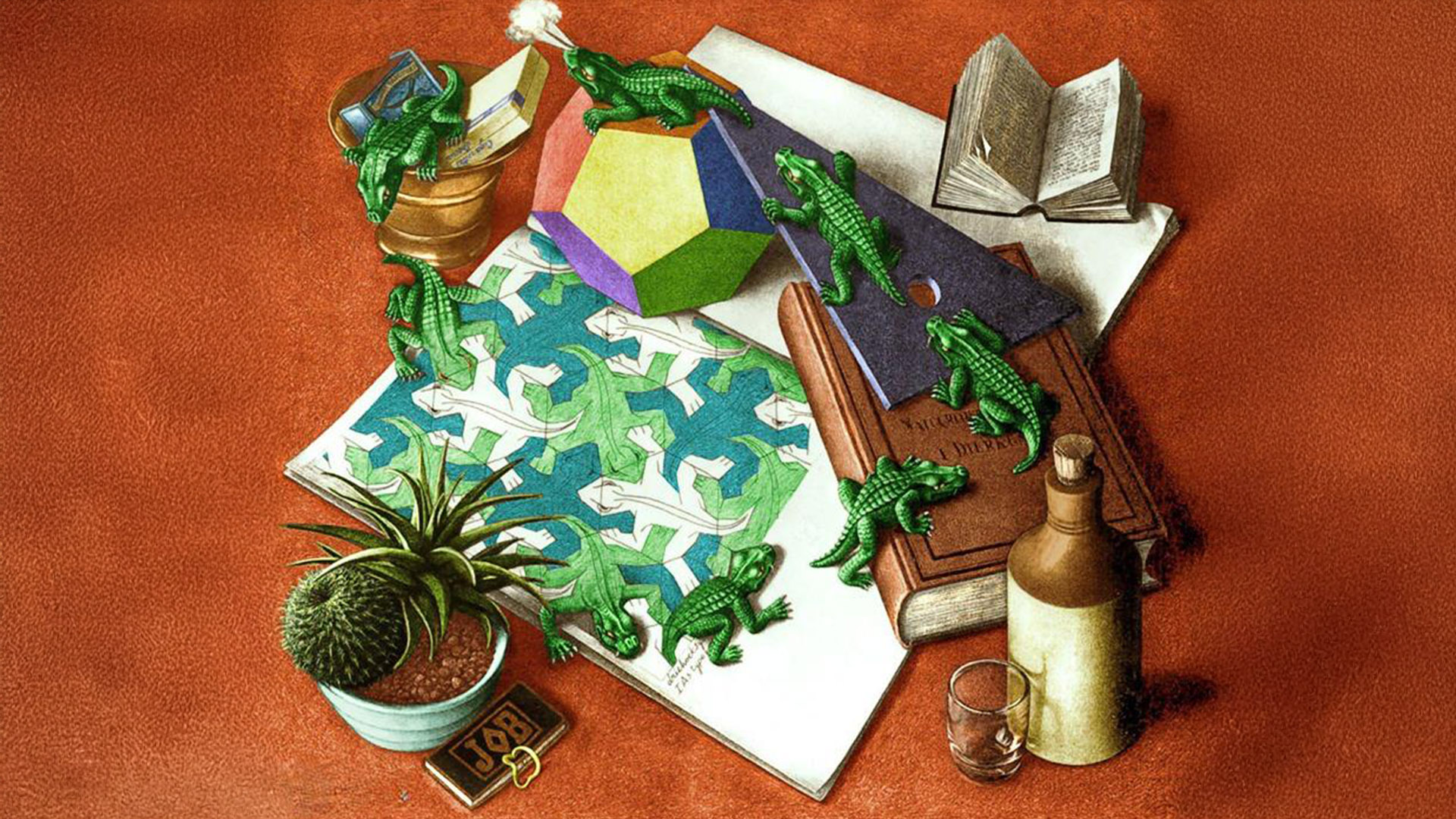

This isn’t fiction. But to understand the nuance, we’re borrowing metaphor from a world many know: Boardwalk Empire. Not to sensationalize or villainize today’s corporate leaders, but to shine a light on the quiet power, complex dynamics, and difficult decisions that define every board seat in America.

Because if Nucky Thompson was a master of navigating factions, influence, and fragile alliances—well, welcome to the modern boardroom. The weapon isn’t bootleg gin. It’s a revised equity plan. The hit isn’t with a Tommy gun. It’s a leak to the press. And the real action? It’s behind the velvet rope—where only a few are invited, and fewer still speak truth to power.

Today’s boards are populated with deeply capable people—experienced, committed, and often walking tightropes between stakeholders, shareholders, and social responsibility. And yet, patterns persist:

- The Executive Committee: operates like a wartime council—called in for urgent action, real decisions, and cleaning up strategic messes when the full board’s on vacation. Think of it as Nucky’s inner circle: fast, loyal, and quietly ruthless.

- The Audit and Risk Committee: is chaired by the Richard Harrow of the board—quietly heroic, surgically precise, and the last line between reality and restatement. He doesn't say much—but when he does, it lands.

- The Compensation Committee: is led by a modern Rothstein: cool, measured, data-driven, always calculating the long-term consequences of short-term incentives—and always ten steps ahead.

- The ESG/Sustainability Committee Chair: brings Margaret Schroeder’s clarity and conscience to a landscape often cluttered by greenwashing and good intentions.

- The Nominating and Governance (NomGov) Committee: is the behind-the-scenes power broker—deciding who’s in, who’s out, and how diversity is defined (or diluted). Think of it as Chalky White’s crew—underestimated, quietly powerful, and deadly serious about respect.

- The Technology/Innovation Committee: is led by the likes of Owen Sleater—ambitious, forward-thinking, and ready to shoot holes in legacy systems with precision. They live in the future but often clean up messes from the past.

- The Chair: plays the Nucky role—not out of ego, but necessity—balancing diplomacy, accountability, and the need to occasionally kill an idea without leaving fingerprints.

- General Counsel: is the Eli—smart, loyal, and carrying the weight of every disclosure and silence while managing to stay one compliance misstep ahead of disaster.

- Marketing and IR leads: channel Lucy and Mickey—charismatic communicators navigating between storytelling and spin, dressed to distract and trained to deflect.

- Strategy Consultants: sit like Johnny Torrio and Meyer Lansky at the end of the table—focused on outcomes, legacy, and the exit multiple. Masters of plausible deniability with beautiful decks.

- Executive Pay Advisors: They’re the ultimate insiders—part therapist, part tactician, part confessor. They know your pay structure better than your spouse does—and sometimes, they know you’re getting divorced before you do. When done right, they bring clarity, candor, and calibrated courage to the most sensitive discussions. When done wrong? Well, that’s how you end up on the front page.

- And the Corporate Secretary:—our Eddie Kessler—impeccably professional, invisible when needed, indispensable when the heat rises. He never speaks out of turn, but somehow always knows what happens next.

This story isn’t about criminality. It’s about complexity. It’s about high-functioning boards that make courageous decisions—and the few that don’t. It’s about governance under pressure, and the real cost of silence, complacency, or unchecked charisma.

So no, this isn’t a takedown. It’s a reflection. A wink. A warning. A tribute to those who get it right—and a nudge to those who don’t.

Ready? Let’s take a walk behind the velvet rope.

Because in Board-Walk Empire...

It’s not personal.

It’s just fiduciary.

Chapter I: The Velvet Rope Club

Let’s not pretend: many board seats are still filled the way nightclub VIP lists used to be—favor, fashion, and fear of exclusion. Don’t have industry experience? Doesn’t matter. You went to Stanford? Close enough. Your last gig was a stint as a lifestyle influencer with a large “executive presence”? Welcome to the comp committee.

For over forty years, I’ve watched from the outside—sometimes invited in, more often called to clean up the wreckage. From the paneled rooms of midtown Manhattan to the glass cubes of Silicon Valley, the view from just outside the velvet rope has revealed one absolute truth: access isn’t about merit, it’s about trust, proximity, and a dash of mythology.

Getting on a board used to mean you were retired, rich, and reliably agreeable. Today? You still need two out of three.

Boards have evolved—some heroically, others hysterically. The worst ones look like old Atlantic City: full of neon, noise, and not a single soul who reads the fine print. The best? They’re like speakeasies for brains and backbone. But make no mistake—this club still has a rope, and not everyone makes it past the bouncer.

The Worst We’ve Seen

- A director fell asleep during a live earnings call—on video.

- A CEO’s brother-in-law was nominated to the board because "he has a good feel for crypto."

- One company had four comp committee chairs in one year. It wasn’t musical chairs—it was an HR horror show.

- A board retreat included private falconry, guided mushroom ceremonies, and a 6-figure wellness consultant who later billed for “vibe stabilization.”

- In one instance, a director approved a nine-figure deal without reviewing the M&A deck because "he had seen a similar one a few years ago."

These aren’t jokes. They’re minutes—buried between the bullet points and the bourbon.

The Best We’ve Witnessed

- A board chair who stepped down after pushing a brilliant but exhausted CEO too far—because performance without sustainability isn’t leadership.

- A director who halted a rushed transaction because the enterprise risk hadn’t been modeled post-close.

- A nonprofit board that rejected a $25 million donation because the donor’s terms compromised independence.

- A tech board that called a 3-day offsite just to solve for ethics in algorithmic design. The result? Transparent AI policies before the media demanded them.

- An executive committee that rejected a retention grant despite losing a key leader—because the person had already given notice three times and was no longer leading anyone.

These aren’t fairy tales. They’re governance at its best—sharp, engaged, and unwilling to be fooled by charisma or cover slides.

What’s Inside the Rope

Inside, the air is rarified. The coffee is artisanal. And the minutes are both a shield and a time bomb. Behind closed doors, we’ve seen:

- Powerful voices go mute when groupthink takes hold.

- Brilliant questions buried beneath bonus envy.

- Audit chairs with nerves of steel—and comp chairs who giggle at burn rate charts.

The truth? The boardroom is rarely a den of thieves. It’s more often a cocktail of good intentions, partial attention, and strategic self-preservation.

What separates the best from the rest isn’t credentials. It’s courage. It’s knowing when to speak, when to vote no, and when to ask: Who’s not in this room that should be?

Next stop: the hood ornaments, the ghosts, and the glamour shots. Because up next—we talk about the people who get in for all the wrong reasons.

Stay close. The rope’s just starting to lift.

Chapter II: Hood Ornaments & Ghosts

Some board members sparkle in the proxy. They glow on the corporate website. They look fantastic on the holiday card. And they contribute absolutely nothing.

Let’s start with the hood ornaments—those high-wattage names brought on for optics. Former senators. Retired generals. Celebrity founders. Media darlings who once launched a hashtag campaign and now chair the Technology Committee (because they once had a MySpace page).

These directors show up, sign off, and smile for the group photo. When they speak, it’s usually in aphorisms. When they ask questions, they’re often rhetorical. And when they vote, it’s “yes,” unless the catering was late.

The worst I’ve seen? Try this:

- A tech company proudly appointed a retired astronaut to their board. Brilliant guy, legendary pilot. Couldn’t spell EBITDA and thought equity dilution was a fuel leak.

- A Fortune 100 board brought on a pop culture icon to chair its DEI committee. They made headlines. They also missed a workplace harassment crisis brewing under their nose.

- One publicly traded company recruited a former U.S. senator purely to win regulatory favor. He didn’t know the product. He didn’t know the business. He thought the cloud was weather-related.

- A billion-dollar healthcare company added a fashion designer to the strategy committee. Her contributions included, and I quote, "aesthetic cohesion."

And then there are the ghosts. These are the directors who were once brought on with great fanfare but have since faded into the high-thread-count background. You see their name on the attendance sheet, but you never hear their voice. They haven’t read the proxy. They haven't logged into the board portal since 2021. And when the hard questions come up, they suddenly need to “circle back.”

Ghosts are more dangerous than hood ornaments because they lull everyone into thinking accountability is collective. It’s not. It’s individual. And if you’re sitting silently while questionable decisions fly by? You’re not a director. You’re a decorative liability.

I’ve seen entire committees where the brightest person in the room was the external auditor’s assistant. I’ve watched governance chairs defer to whoever spoke last. I’ve heard audit chairs say, “Let’s not get too technical,” while discussing internal control failures.

But I’ve also seen the flip side. Directors who’ve done their homework. Who bring courage, not just credentials. Who ask the hard question even when the answer will make everyone uncomfortable. Who treat governance not like a trophy, but like a calling.

You don’t need fame to be effective. You need focus, fluency, and the willingness to be unpopular. Especially when it counts.

Next up? The real insiders. The fixers. The consigliere class. Advisors, consultants, and counsel—the ones who shape the decisions you think the board made all on its own. The real insiders. The fixers. The consigliere class. Advisors, consultants, and counsel—the ones who shape the decisions you think the board made all on its own.

Chapter III: The Good, The Bad, The Brilliant, and The Ugly

Let’s start with the good. Because it exists—quietly, powerfully, and often without credit. For every governance dumpster fire I’ve witnessed, I’ve also seen flashes of pure brilliance. Moments when someone stepped up, called BS with surgical precision, and saved a company from disaster—or at least from landing on the front page of the Wall Street Journal for all the wrong reasons.

The Good

These are the outliers. The heroes. The directors who read the footnotes, did their homework, and showed up not just in body, but in boldness.

- A board chair once halted a unanimous vote, looked everyone in the eye, and said: “Let’s revisit this when we’ve slept. If it still feels right in the morning, I’ll back it.” Translation: I have a backbone and a calendar.

- A first-time director—young, female, outsider—called out a blatant accounting gimmick that three Big Four alumni missed. She was right. The company avoided restating earnings by a margin thinner than the CFO’s last nerve (and even thinner than his hairline).

- I’ve seen comp committees that refused to approve new grants for underperforming executives—despite pressure from recruiters, peers, and a CEO working overtime on his martyr complex. Instead, they retooled incentives from the ground up, tied them to real KPIs, and watched the stock outperform its peers for five straight years. No tearful PowerPoint required.

The Bad

The bad isn’t always malevolent. Sometimes it’s just...mediocre. But make no mistake—it spreads like corporate pink eye.

- I once watched a board vote to increase the CEO’s bonus target after the performance year ended—because “he tried really hard.” This is what happens when governance turns into grade school.

- A well-known company greenlit an M&A deal that destroyed billions in value. The strategy committee? They spent more time picking the retreat location than reviewing the deal structure. (Fun fact: the deal cratered before the post-merger swag arrived.)

- A director once said, "I trust the numbers, I just don’t really understand them." He was on the audit committee. I wish I were joking.

- The comp committee approved retention bonuses for execs who had already accepted jobs elsewhere. One forwarded the offer letter from his new employer—then voted himself a stay bonus for his two-week notice. The audacity was breathtaking. So was the severance.

The Brilliant

The brilliant ones don’t just do their job—they elevate the standard. They change the weather in the room. They make others better simply by not accepting average. They aren’t the loudest. But when they speak, even the consultants stop scrolling.

- One director, in the middle of a heated debate, quietly asked: “What are we solving for here?” That’s it. No finger-pointing, no whiteboard. It reframed the entire discussion—and reminded everyone that business school jargon is no substitute for clarity.

- I watched a comp chair demand that the CEO walk through the LTIP modeling without the consultant present. What followed was a masterclass in intellectual accountability—and several awkward silences.

- A nom/gov committee chair brought in two candidates no one had considered—neither with C-suite experience, both with deep operational fluency. They became two of the strongest voices on the board within a year. The other directors are still asking, "Why didn’t we think of them first?" Spoiler: they didn’t want to.

The Ugly

And then there’s the truly ugly: where bad becomes brazen. Where ego, entitlement, and ethical blind spots collide like drunk drivers at a SPAC convention.

- One director told a whistleblower to “tone down the drama” in a harassment report. She was gone within a month. So was the company’s reputation.

- Another attempted to expense his mistress’s international travel as “board engagement.” (Yes, we declined. No, he didn’t resign.)

- At one company, an entire board refused to remove a clearly compromised CEO because, and I quote, “he’s a visionary.” He was later indicted. Turns out, the only thing he was visionary about was his personal exit strategy.

What Makes the Brilliant Different?

They listen more than they speak. They ask questions that make people squirm. They know when to be loyal—and when to be lethal. They understand that good governance isn’t about control. It’s about courage.

And they never confuse access with insight. They don’t care about the parking spot. They care about the truth.

Up next? The mold breakers. The rebels. The rule-rewriters. The ones who got into the boardroom because someone, somewhere, finally decided to break the template—and thank God they did.

Chapter IV: The Mold Breakers

Not every director comes from the traditional mold—thank God. In fact, the best ones often don’t.

The mold breakers are the rebels, the rule-rewriters, the edge-dwellers who weren’t supposed to be in the room but got there anyway. Not because of pedigree, but because of perspective. Not because they played the game, but because they questioned the rules. And when they spoke, the air changed.

They didn’t come from CEO pipelines or Ivy League finance clubs. They weren’t part of the good old boy network, didn’t summer on The Main Line, and didn’t roam the ivy-covered halls with a Rolodex and a trust fund. They didn’t roll in with five other board seats and a sailboat named Governance. They came from places like the factory floor, community health clinics, software startups, or nonprofits that did more with $5,000 than most companies do with $5 million.

Who They Are

- A former nurse who spotted mental health burnout trends in a healthcare company before the CHRO had even updated the EAP link on the intranet.

- A supply chain savant who spent 20 years in logistics and asked one simple question about fulfillment costs that shaved $8 million off the bottom line.

- A millennial founder who had built, sold, and flame-crashed two startups—and lived to tell the board exactly how culture kills companies from the inside out.

- A high school principal turned public company director who asked tougher questions about accountability, leadership, and ethics than the entire comp committee put together.

- A retired executive compensation consulting icon who once advised more Fortune 500 boards than the Big Four combined. He brought depth, memory, and moral clarity to every pay conversation. He could dismantle a flawed incentive plan in four words or fewer, and once stopped a CEO's bonus mid-meeting with nothing more than a raised eyebrow and a quiet, "Help me to understand."

Why They Matter

Because they make everyone else uncomfortable in the best way. They question sacred cows. They challenge jargon. They bring field-tested wisdom and fresh eyes to rooms full of recycled perspectives.

They’re the ones who:

- Ask, “Why are we solving this with equity when the actual issue is leadership?”

- Say, “I don’t care if that’s market. Is it right?”

- Notice that no one’s mentioned the customer in the last 47 slides.

They don’t always speak in polished soundbites. But when they do speak, it cuts to the bone.

But Here’s the Rub

Most boards say they want these people—but they rarely hire them. Why? Because mold breakers don’t look like what governance expects. They’re harder to define, trickier to slot into neat little bios, and more likely to ask, "Who built this structure and why does it feel like a museum?"

But the boards that do bring them in? They thrive. They adapt. They build resilience that isn’t just for earnings calls—it’s for existential crises.

And here’s what makes them dangerous in the best way: they’re not there to preserve the past. They’re there to imagine a future where performance means more than a PowerPoint and courage is part of the compensation plan.

So let’s raise a glass to the mold breakers—the nontraditional, the curious, the inconvenient, the quietly revolutionary.

Because without them, every boardroom is just a country club with a slide deck.

Next up? The venture and private equity seats—the investors who want a say, a seat, and a liquidity event, in that order.

Chapter V: VC, PE, and the Price of Admission

If the mold breakers rattled the chandelier, the venture capitalists and private equity titans showed up with crowbars—and a term sheet. These are the investors who don’t just want a seat at the table. They want the table. And they’ll tell you exactly where to sit.

These directors aren’t always subtle. They’re not here for the coffee or the small talk. They’re here for velocity, returns, and a clean exit. Preferably before the third quarter.

The VC Seat

In venture-backed companies, the boardroom isn’t a place of oversight—it’s a launchpad, a triage tent, and occasionally a family therapy session with a burn rate. The VC rep often comes armed with three things: a dozen portfolio company war stories, an aggressive roadmap, and a conviction that this one will be different.

They bring:

- Unflinching focus on product-market fit.

- A power-user’s grasp of growth metrics.

- And an uncanny ability to quote Paul Graham during compensation reviews.

But they also bring fragility. They’re betting big on vision, and they don’t have time for long debates about consensus-building or cultural nuance. If you need a committee to approve your pitch deck, they’ll replace the committee—and you.

The PE Seat

Private equity directors are different. They don’t speak in metaphors. They speak in margin. They walk in with a spreadsheet, a six-quarter plan, and a body language that screams, “We own 73% and your job security is an Excel cell away.”

They bring:

- Relentless discipline.

- A habit of finding inefficiencies others politely ignore.

- And a rotating cast of “interim CFOs” who magically appear between board cycles.

I’ve seen PE boards install entire leadership teams before the coffee cooled. I’ve watched them surgically dismantle bloated org charts, drop SG&A by 30%, and increase EBITDA by sheer willpower and a deeply suspicious travel policy.

And when things go sideways? They don’t write memos. They write replacements.

The Good Ones Know

Not all VC and PE directors are blunt instruments. The great ones? They know when to accelerate and when to pause. They recognize that culture isn’t a KPI—but it can kill KPIs if ignored. They bring accountability and urgency, yes—but also insight.

I once watched a PE board member talk a founder off the ledge—not with a valuation cap, but with humility. “I’ve seen this before,” he said. “You’re not failing. You’re adapting.” The company turned the corner. And no one got fired that week.

Behind the Turtlenecks: Anecdotes from the Term Sheet Trenches

Let’s not pretend the VC/PE crowd isn’t also wildly entertaining. There’s the VC partner who demanded a strategic pivot based on a podcast he listened to in an Uber. Or the PE director who referred to the customer support team as "margin erosion with headsets." And who could forget the investor who spent a full hour questioning the ethics of issuing retention bonuses—right after negotiating a waterfall clause that made Machiavelli look like a middle school guidance counselor?

Then there was the investor who insisted the company shift to a DTC model because his niece sold vintage sweaters on Etsy. Another made the CEO scrap a perfectly good earnings deck because the font wasn't 'investor confident enough.' And one particularly hands-on VC tried to lead a product visioning workshop that included a game of musical chairs to demonstrate market volatility.

They travel in packs, eat strategy decks for breakfast, and love metaphors that reference space travel: “We’re not trying to build a better bike; we’re trying to land a rocketship on a bar napkin.” One famously brought a dry-erase marker to a board meeting held in a historic wood-paneled dining room—because “go-to-market doesn’t wait for walnut trim.”

Their fashion? Black turtlenecks for the VCs, Loro Piana for the PE crowd. Their diet? $28 smoothies and ruthless cost restructuring. Their mood? Simultaneously bullish and deeply disappointed in you.

And when the time comes to exit? Picture a silent heist movie: all black turtlenecks, carefully timed secondary offerings, and one whispered word: “Liquidity.”

But jokes aside, they’ve reshaped governance. Not always for the worse. Sometimes, they’re the only adults in the room—just very impatient, spreadsheet-wielding adults with a liquidity fetish.

So, the next time a VC says, “Let’s 10x this,” or a PE director says, “We’re restructuring the value creation narrative,” just smile. They might bulldoze your budget, but if you’re lucky, they’ll leave you with a business that works. or a PE director says, “We’re restructuring the value creation narrative,” just smile. They might bulldoze your budget, but if you’re lucky, they’ll leave you with a business that works.

Next up? The Casino Effect—where boardroom decisions start to look less like strategy and more like gambling with someone else’s chips.

Chapter V: The Casino Effect — Reloaded

If the PE boardroom is a war room, the hedge fund-influenced one is a casino—half velvet rope, half back alley, where fortunes are made, CEOs are body-checked into early retirement, and the boardroom bar tab is paid in proxy votes. But unlike Vegas, the house doesn’t just win—it rewrites the rules, stacks the deck, and charges you a restructuring fee for showing up.

Hedge Funds: The New Pit Bosses

They don’t whisper. They detonate. Hedge funds arrive not to collaborate, but to extract. Their favorite door prize? A 13D, an open letter, and three proxy nominees you’ve never met but now have to smile at across the boardroom table.

They:

- Demand board seats.

- Launch blistering media campaigns.

- Publish 80-slide decks titled “Unlocking Value,” subtitled: “Firing You.”

I once watched a CEO escorted out by security—after an activist fund took over the board with a proxy win that cost less than the company’s last holiday party. Their next move? Replace half the board, cut R&D by 60%, and double the dividend. Wall Street cheered. Employees wept.

And yet—sometimes they were right.

One CEO threw a tantrum on live television after an activist fund publicly accused him of burning cash “like a hedge fund birthday cake.” By the time the closing bell rang, he had been “voluntarily transitioned,” his portrait unceremoniously removed from the lobby.

Short-Sellers: Casino Card Counters With Teeth

Short-sellers are governance’s street-level snipers. Equal parts clairvoyant and chaos agent, they bet on failure the way Nostradamus bet on plagues.

David Einhorn once torpedoed a boardroom strategy session mid-meeting by releasing a white paper accusing the company of "creative math" and "executive optimism disorder." The stock dropped 19% before lunch. The comp committee chair spilled her green juice on the ESOP tables.

Another CEO, red-faced and trembling, threatened legal action against a short-seller on a CNBC segment—only to have his general counsel resign three hours later and his board call an emergency meeting over Zoom. That same CEO was replaced within the month. Nobody even printed out his farewell speech.

The Institutional Casino Floor

Once buttoned-up and boring, institutional investors now make noise like they’re auditioning for a Rage Against the Machine reunion. BlackRock’s stewardship team has become a permanent fixture in every board’s nightmares, and CalSTRS ranks diversity like the AP Top 25.

A board I worked with was blindsided when an ISS downgrade triggered a domino of dissent from index giants. The chair, known for his collection of Hermes ties and a staunch allergy to Zoom, resigned over email. His replacement had a septum piercing and a Master’s in climate finance.

Activists: Wolves in ESG Sweaters

Ah yes—the activists. Wolves in Patagonia fleece. They come quoting Larry Fink and leave quoting Sun Tzu.

One ESG crusader was so persuasive he was invited to join the sustainability committee—only to launch a hostile takeover from within. Three months later, the CEO was out, the board had three new members, and ESG went from reporting line to mission statement.

Another activist emailed a 23-page sustainability manifesto at midnight and demanded a board vote by 8 a.m. It was titled, "The Path Forward" but should’ve been called "The Path Out." Three directors resigned before breakfast.

The Ghost of Greenmail Past

Let us never forget the OGs—greenmailers like Carl Icahn, T. Boone Pickens, Saul Steinberg, Paul Bilzerian, and Sir James Goldsmith. They didn’t need TikTok or Reddit. Just a fax machine, a press contact, and a billion-dollar bluff.

Icahn famously threatened to break up TWA—twice—before walking away with a golden parachute and selling the parts like he was running an airline garage sale. T. Boone tried to take over Gulf Oil, Unocal, and others with the Texas charm of a grizzly bear in an oil slick. Steinberg leveraged his tiny company, Reliance Insurance, into takeover threats that made Fortune 500 CEOs hyperventilate. Goldsmith? He rolled up companies like British newspapers and French food groups with the elegance of a Bond villain.

And then there was Paul Bilzerian, the father of Instagram’s favorite shirtless millionaire. He was once the crown prince of hostile bids—until the SEC chased him off the battlefield.

One infamous episode involved a Midwest conglomerate whose chairman was handed a single sheet of paper from a young analyst. The letter read: “Sell. Or we will.”

The stock surged. The board caved. A billion-dollar division was divested in 11 days.

The company’s holiday party that year featured karaoke, shrimp cocktails, and multiple lawsuits—plus a conspicuously empty chair where the chairman used to sit.

Retail, Reddit, and the Rise of Meme Governance

Then came the Reddit revolution. Governance by emoji. One tweet turned a legacy retailer into a meme legend: “Boardroom average age: 79. Innovation score: dial-up.”

The next morning:

- 4 million new retail investors bought in.

- 1 board member deleted their LinkedIn.

- The IR team considered witness protection.

The earnings call Q&A included questions about Dogecoin, plant-based meat expansion, and why the CFO looked "so stressed."

Why It Matters

Because sometimes—just sometimes—the house should burn.

Governance isn’t polite conversation over cucumber sandwiches. It’s war, theater, poker night, and Renaissance fair all rolled into one. Activists don’t always get it right—but complacency never does.

The best boards? They adapt. They listen. They learn when to hold ‘em, when to fold ‘em, and when to throw the whole damn deck out.

So ante up, straight face on, and keep your 10-K clean. The pit bosses are watching—and they brought backup.

Next: Proxy War Paint—where battle lines are drawn in ink, tweets, and shareholder resolutions.

Chapter VI: Proxy War Paint

If The Casino Effect is the backroom brawl of corporate governance, Proxy War Paint is the political theater—equal parts chess match and cage fight. Here, strategies are drawn in whitepapers and tweets, alliances forged in hotel bars, and reputations slashed by a single line from a proxy advisory firm.

Welcome to the corporate colosseum, where shareholders sharpen their voting pencils like blades and every AGM might end with a board chair bleeding out over the charcuterie tray.

The Puppet Masters: ISS & Glass Lewis

Let’s stop pretending. Institutional Shareholder Services (ISS) and Glass Lewis aren’t “advisors”—they’re the Vatican and the Kremlin of shareholder voting. Their annual reports don’t just influence votes—they decide them. Think of them as the Tammany Hall bosses of board governance—shadowy, efficient, and terrifyingly unaccountable.

Need your director slate approved? Your Say-on-Pay passed? You better hope ISS likes your tone—and that you bought the deluxe "research package," complete with “engagement opportunities” and “custom voting policy alignment.” Translation? Pay to play.

And it’s not just a bad look—it’s structural. ISS, bought and sold more times than a Times Square streetwalker, was famously acquired by MSCI and then sold again to private equity. When ISS was under MSCI, it was the only company not evaluated by ISS’s own governance ratings. That’s not hypocrisy—it’s performance art.

Today, ISS and Glass Lewis both offer "guidance services" and "navigational help"—through entirely separate but conveniently aligned consulting arms. That’s right: if you want to know why your board got a failing grade, you can pay a sister subsidiary to interpret the black-box algorithm you never got to see in the first place. It’s like being mugged, then charged for directions to the nearest police station.

The SEC and DOJ have tried to intervene. In 2019, the SEC proposed rules to force proxy firms to disclose conflicts and give companies a chance to respond. ISS sued. Glass Lewis hissed. And the battle turned ugly. Congressional hearings. White papers. Open letters. At one point, it felt like the regulatory version of the Gunfight at the OK Corral—with two lobbyists and a thousand lawyers.

And yes, the war rages on. The SEC backed off slightly under political pressure, but the case isn’t closed. ISS still behaves like it’s untouchable. Glass Lewis has refused transparency requests with all the grace of a wounded animal backed into a governance corner.

The Big Guns: State Street, Fidelity, and Dimensional

Next come the institutional giants. Vanguard, BlackRock, State Street, Fidelity, Dimensional. They wield quiet power—the kind that doesn’t shout, just shows up with 10% of your shares and a spreadsheet that says you’re doing it wrong.

State Street once torpedoed a Fortune 200 board chair’s reelection after a poorly timed joke about “ESG fatigue.” Fidelity flagged a $500,000 CEO car allowance as “tone-deaf.” Dimensional doesn’t even bother to reply to your lawyer’s call. They just vote no—and send your IR team a condolence fruit basket.

These aren’t investors. They’re kingmakers with ESG scorecards and Harvard Business Review subscriptions. And their thumbs-up or thumbs-down can define your entire career.

The CalPERS Effect: Permanent Opposition

Then there’s CalPERS—the Spartan hoplites of shareholder activism. If your proxy card lands on their desk, odds are the answer will be no.

CalPERS once opposed an entire board for lacking “climate fluency”—and won. Another time, they publicly shamed a tech company for having an all-male board during Women’s History Month. Within 48 hours, the company added three women, launched a DEI task force, and issued a formal apology. CalPERS responded by abstaining. Cold-blooded.

What makes CalPERS dangerous isn’t just their vote. It’s their example. When CalPERS goes to war, other funds follow. Their playbook becomes gospel, and their resolutions? The Ten Commandments of shareholder engagement.

The Real War Paint: Consultants, Coalitions & Proxy Cunning

Behind the scenes, it’s Game of Thrones meets The Godfather.

- Proxy solicitors with burner phones whispering opposition strategy over $90 steaks in Midtown.

- Governance consultants ghostwriting shareholder letters with more venom than a Scorpion III poison pill.

- Activists leaking boardroom recordings to sympathetic journalists who live-tweet the chaos.

- PR firms crafting tearjerker narratives about long-suffering shareholders forced to rescue a company from its own comp committee.

Take the infamous Herbalife saga. Bill Ackman spent years lobbying institutions, regulators, and the press to short the company into oblivion. Carl Icahn counterpunched. They called each other names on national television. ISS blinked. The board panicked. A director resigned mid-fight. It was blood sport.

Or remember David Einhorn’s war on Apple? He sued them for sitting on too much cash. The board scoffed. Shareholders voted in his favor. A week later, Apple launched a $100 billion share buyback. That’s not activism—it’s corporate hostage-taking with a velvet rope and an IR contact list.

And we haven’t even touched the greenmailers of yesteryear: T. Boone Pickens, Carl Icahn, Saul Steinberg, Victor Posner—men who perfected the art of shaking down companies with threats of control and golden parachutes.

Pickens once made $30 million just by threatening a takeover of Unocal. Posner once fired the entire board of Sharon Steel. These guys weren’t activists. They were pirates in bespoke suits.

Proxy Season: March Madness for Governance Nerds

If March Madness had spreadsheets and poison pills, it’d look a lot like proxy season. Hundreds of companies. Thousands of proposals. A million lawyers, bankers, and sleep-deprived IR teams all bracing for the dreaded ISS report drop.

The brave few lean into it. They engage. They offer repentance—clawbacks, refreshed boards, ESG metrics with real teeth. Others hide. Or worse: overreact. One company held a 9-hour shareholder meeting in which every board member read a personal statement. Another tried to bribe a rating analyst with Taylor Swift tickets. (It didn’t work. They got flagged for pay disparity.)

The Bottom Line: Blood, Sweat & Ballots

Proxy war paint isn’t makeup. It’s armor. It covers bruises, scandals, and sins of omission. But it also invites scrutiny—the kind that reveals what’s beneath the governance glamor: broken promises, stale boards, and unchecked power.

The game has changed. Votes are weapons. Disclosure is ammunition. And your annual meeting? It’s the opening night of a black-tie cage match, complete with Molotov footnotes and ESG grenades.

So light the candles. Sharpen your pencils. And never forget:

It’s not personal. It’s just fiduciary.

Chapter VII: Boardroom Bacchanalia

If the boardroom is a sacred space of strategy, governance, and fiduciary responsibility—then what explains the vodka bottles in the conference room fridge, the passive-aggressive floral arrangements, and the CFO who once stormed out of an earnings call dressed as Elton John?

Welcome to Boardroom Bacchanalia: where the grown-ups in charge forget their manners, their bylaws, and sometimes their pants. If Chapter VI was blood sport, Chapter VII is reality television with stock options and expensed limousines.

The Stories They Swore You’d Never Hear

- One unicorn CEO decided to “break the ice” with his new board by installing a champagne vending machine in the boardroom. The audit committee was horrified. The compensation committee took selfies.

- At a Fortune 100 energy company, a director allegedly faked a medical emergency to avoid voting on a CEO severance package. Two days later, he was spotted at Pebble Beach teeing off under a different name. He was later dubbed "The Houdini of Human Capital."

- In a retail conglomerate’s closed-door strategy session, the CEO brought in a performance artist to do an interpretive dance about "digital transformation." The head of strategy vomited in a recycling bin. The board approved a $75 million transformation budget the next day.

When Chairs Go Wild

Let’s be honest: some board chairs are bastions of wisdom. Others are Bacchus in Armani. One was caught passing notes to the CEO during a shareholder Q&A, misspelling his own name and writing “LOL, ignore her.” Another had a standing rule that no meeting could last longer than 90 minutes or extend past cocktail hour.

And then there’s the chair who scheduled quarterly board meetings in Bermuda. “Tax efficiency,” he claimed. Coincidentally, his mistress ran the hotel’s concierge desk.

The CFO Who Wept, the GC Who Leaked, the CHRO Who Vanished

Behind every “well-functioning” board is an executive team walking a highwire over a moat of crocodiles.

- A general counsel once leaked board minutes anonymously to a reporter—not for whistleblower glory, but because he was passed over for an options refresh.

- A CHRO ghosted the comp committee for three weeks during a pay equity audit. When she resurfaced, she claimed she was “at a silent retreat in Sedona.” Her Instagram suggested otherwise: Cabo, cocktails, and a guy named Sven.

- And then there's the CFO who broke down crying during a board review of missed earnings targets. The board applauded his "vulnerability." The next quarter, he inflated earnings and got a retention bonus.

ESG: Excessive Shenanigans Guaranteed

You want ESG horror stories? Try the multinational that launched a biodiversity initiative by releasing butterflies into the boardroom. No one read the briefing packet about native species. HR spent the next week filing OSHA incident reports for bites, stings, and one hospitalization.

Or the mining company that announced a “net-zero by 2040” pledge—right after awarding the CEO a new Gulfstream. When asked about the optics, the chair said, “It’s a hybrid jet.” (It wasn’t.)

Not-For-Profit, Not-For-Logic

Then there are the nonprofits—where fiduciary dysfunction wears a cardigan and smiles politely as Rome burns.

One arts nonprofit spent three board meetings debating the color of the executive director’s new business cards. Another refused to approve cybersecurity upgrades because “cybercrime sounds made up.” And in a legendary hospital system, a board member tried to expense his golf club dues under "wellness.” It was approved.

Fiduciary Follies: Secret Friends, Interlocks, and Jet-Set Oversight

Sometimes it's not just about bad behavior—it's about secret behavior. The kind that sounds like a subplot from Succession but comes straight from board minutes and SEC filings.

- One prominent retailer discovered—thanks to a whistleblower—that their board chair had been romantically involved with the CEO for two years. The board learned about it when the chair accidentally used her company email to send a Valentine's Day dinner reservation to the CEO’s assistant. That year's 10-K read like a breakup text.

- At a publicly traded manufacturer, two directors were discovered renting factory space to the company—via LLCs they both conveniently forgot to disclose. When asked, one said, "I thought it was just good vertical integration."

- A biotech firm listed office space in a San Diego building. It was later revealed that the building was owned by the lead independent director’s cousin. When challenged, he replied, “It’s not family if you don’t talk at Thanksgiving.”

- At a medtech company, a director's private aircraft was quietly added to the approved corporate travel vendor list. He billed $800,000 over 18 months. When asked why, he said the board needed “a consistent flight experience.”

These interlocks, conflicts, and cozy sweetheart deals often come with a smirk and a shrug. The real surprise? They’re rarely challenged—until the shareholder lawsuit lands with the ferocity of a falling chandelier.

The Bacchus Awards for Boardroom Insanity

- Best Supporting Role in a Breakdown: The director who quit mid-call because the snacks weren’t gluten-free.

- Most Misguided Metaphor: A biotech CEO who compared shareholder dilution to “spreading the love.”

- Lifetime Achievement in Excess: The private equity chairman who hired an astrologer to advise the board on M&A timing. It worked once. He now has her on retainer.

The Bottom Line

Boardroom Bacchanalia isn’t a one-off. It’s a pattern—enabled by weak governance, disengaged directors, and the occasional martini cart. But here’s the kicker: some of these companies still outperformed. Because even amid the madness, markets love a good story.

So raise a glass, but tighten your conflict-of-interest policy. In governance, as in Rome:

Eat, drink, and disclose.

Chapter VIII: Nonprofit Nonsense and Glory

If boardroom dysfunction in the for-profit world is a feature—not a bug—then in the nonprofit universe, it's often divine comedy disguised as service. Here, the stakes may be mission-driven, but the governance gaps are wide enough to drive a donor-funded Range Rover through. And let’s face it: when no one's watching—or when everyone thinks no one's watching—things tend to go off the rails with tax-deductible flair.

Invisible Crowns and Untouchable Egos

The nonprofit board is often a curious cocktail of power, passion, and well-meaning amateurs. Think PTA president meets Downton Abbey, but with more spreadsheets and passive aggression. The dysfunction isn’t always intentional—it’s just cloaked in righteousness. After all, what’s a little nepotism when you’re saving the whales?

- One global education nonprofit added a donor’s daughter to the board after she promised to bring in TikTok influencers. Instead, she brought in her boyfriend, who wanted to turn the boardroom into a VR meditation den. They now list “innovation leadership” in their annual report.

- A healthcare nonprofit hired a new CEO handpicked by the board chair. Turns out the two shared more than vision—they shared a mortgage. Conflict of interest? "We're in a partnership of care," the chair said. HR, predictably, did nothing.

- A foundation chair was overheard telling a new board member, "You’re here to nod, not to vote." He meant it. Minutes were taken by his executive assistant, who doubled as his personal astrologer.

Mission Before Metrics… or Something Like That

- At a children’s museum board meeting, the entire governance section of the agenda was skipped so they could debate the theme of the annual gala ("Disco Dinosaurs" won). Minutes from the previous meeting were never approved. No one noticed.

- A conservation nonprofit held its annual board retreat on a private island accessible only by seaplane. When asked why, the executive director said, “The silence helps us reflect on our carbon offsets.”

- A university foundation spent $2.4 million on a new "green" boardroom that featured reclaimed wood from an abandoned whisky distillery. The board never used it. They meet at the Four Seasons.

The Jet Set and the Set-Ups

In the nonprofit world, perks are more subtle—but no less indulgent. One director billed the foundation for luxury bedding “to improve sleep before board travel.” Another received regular upgrades on the charity’s dime because her husband worked for the airline—she said it was "karma, not policy."

Then there are the junkets—I mean retreats. Always in Napa. Always with spa packages. Always booked by the CEO’s executive assistant-slash-event planner-slash-secret lover. A land conservancy once justified a helicopter tour of undeveloped land as “firsthand stakeholder engagement.”

- A health charity ran its annual strategic offsite at a five-star Balinese resort. The board claimed it was to "better understand global health equity." They posted a group photo from an infinity pool.

- An education nonprofit took a board trip to Davos—none of them were invited to the WEF. One director described it as “networking in spirit.”

The Audit Committee? What Audit Committee?

Internal controls in many nonprofits are softer than a Chardonnay-fueled vision board.

- One major arts organization had the same treasurer for 17 years. He was also the only person who knew the online banking password. After his death, the board realized he had been loaning out restricted funds to his brother-in-law’s dog kennel. The organization had to host a benefit concert to stay solvent.

- A religious nonprofit accidentally paid a departing CFO a severance bonus twice. When asked to return the funds, he declined and cited “divine compensation.” He later joined the board of a different nonprofit.

- A public policy think tank forgot to renew its 501(c)(3) status. For three years. Their accountants were also their event bartenders.

And then there are the spectacular meltdowns that make Enron look like a clerical error.

- At the now-defunct Trump Foundation, the board (made up almost entirely of family members) approved expenditures for a $10,000 portrait of the founder, displayed prominently in one of his golf clubs. The New York Attorney General’s office eventually shut the foundation down for what it called “a shocking pattern of illegality.”

- The founder of the Fugees-founded nonprofit, Wyclef Jean’s Yéle Haiti, was found to have paid himself and family members six-figure salaries while less than a third of donations reached their intended causes. Donors received postcards. The IRS received a stack of subpoenas.

- At the United Way of the National Capital Area, then-CEO Oral Suer was sentenced to 27 months in prison for defrauding the charity of over $1.5 million through undisclosed loans and hidden benefits. The board claimed ignorance. Prosecutors claimed willful blindness.

“If You Can’t Find the Conflict, You’re the Conflict”

- A youth mentoring nonprofit was renting office space at above-market rates—from the vice-chair’s real estate firm.

- A cultural foundation outsourced event planning to the founder’s niece, who billed the org $45,000 for a poetry reading and a balloon arch.

- At a food insecurity nonprofit, a board member directed food contracts to her cousin’s catering company. When questioned, she claimed, “It was a family recipe.”

- An animal shelter sold naming rights to a wealthy donor who later used the board seat to push for a full rebrand. Their new logo features a watercolor of her Pomeranian, Sparkle.

And then there’s the dark undercurrent of spineless directors—those who nod in unison, defer to CEOs with unchecked authority, and act more like adoring fans than fiduciaries. These aren’t watchdogs; they’re jellyfish in Brioni. One former board member from a humanitarian nonprofit described it best: “We didn’t govern. We spectated—like a corporate opera without a score.”

In many nonprofits, the board becomes the CEO’s fan club, entourage, and human shield.

- One university president flew solo in negotiating a $100M tech partnership—while keeping the board in the dark. When the deal imploded, the board said they were "shocked" to learn about it. One director allegedly asked, “We’re supposed to approve those?”

- A performing arts nonprofit CEO routinely gave raises to her executive team without board review. When a new treasurer questioned it, he was uninvited from the next board retreat.

- At a development foundation, the CEO and CFO privately redirected donor funds to prop up their favorite side venture: a branded line of nutritional supplements. It took a whistleblower to uncover it. The board? “Disappointed.” The press? Delighted.

The Napkin Budget and the Vanishing Endowment

Budgeting in some nonprofits resembles a game of charades crossed with a magic trick. One executive director once delivered an entire annual budget on a cocktail napkin. It included a line item called “vibe maintenance.”

And the endowments? They vanish faster than donor intent. An Ivy-adjacent nonprofit raided its restricted scholarship fund to purchase a luxury SUV for the development director because “it would make her more relatable to young alumni.”

- A museum board liquidated its climate-controlled archive to build a wine cellar for donor events. The artifacts were moved to storage—in Arizona.

- A community service nonprofit misallocated funds intended for after-school programs to sponsor a director’s campaign for local office. The only reason they got caught? He lost.

The Nonprofit Narcissist Hall of Fame

- The Gala Queen: No prior governance experience. Just a flair for flower arrangements and a vendetta against rival committee members. Controlled 30% of the budget.

- The Chair-for-Life: Installed during the Reagan administration. Claims bylaws are “just suggestions.”

- The Founder-Pharaoh: Considers any disagreement a personal betrayal. Thinks 501(c)(3) stands for “three compliments or you’re out.”

- The Visionary Ghost: Misses every meeting but gives impassioned interviews to the press. Claims credit for every success. Secretly plans a tell-all book.

The Bottom Line

Nonprofit boards are supposed to be guardians of mission and stewards of trust. But without accountability, rigor, and the occasional hard question, they become playgrounds for vanity, hidden interests, and well-laundered chaos.

Just because it's a nonprofit doesn't mean it's non-dysfunctional. And if anyone tells you otherwise, check the footnotes—or the guest list at the board retreat.

Charity begins at home. Governance should, too.

Chapter IX: The Fixers and the Whisperers

They don’t wear name tags, but they know yours. They don’t sit at the table, but they shape the agenda. In every boardroom worth its salt—and many not worth a dime—there lurks a cadre of invisible hands: the fixers, the whisperers, the consultants, and the consiglieri.

Some are legendary. Some are laughable. Some are just expensive mistakes with a PowerPoint license and a thesaurus. But one thing’s for sure: behind every billion-dollar decision (or billion-dollar disaster) is a supporting cast of advisors—some angels, some arsonists.

Executive Pay Consultants: Saints, Sinners, and Spreadsheet Sorcerers

Let’s start with the most whispered-about players in the boardroom drama: the executive compensation consultants. These are the pay whisperers, the market-pricing mystics, the architects of golden parachutes and platinum lifeboats.

The good ones? Legends:

- Frank Glassner—founder of Veritas, with a spine of steel and the uncanny ability to say, "Help me to understand" in a way that made CFOs break into a sweat.

- The late Fred Cook—universally revered as the godfather of executive pay consulting. Quiet but commanding, Cook was a moral compass for a profession often lacking one.

- Peter Chingos—like Frank, a product of KPMG’s crucible, and known for building bridges between data, logic, and fairness. A cerebral powerhouse who mentored a generation.

- George Paulin—data-driven, detail-obsessed, and allergic to BS. His whitepapers often landed harder than some firms’ lawsuits.

- Ira Kay—bold, prolific, and relentless in his crusade for performance-based pay.

- Mark Borges—a former SEC insider and regulatory savant.

- Tim Sparks—a quiet legend and fierce strategic partner to some of the world’s largest boards.

- Robin Ferracone—analytical, balanced, and a leading voice on fairness and pay-for-performance.

And then there are the disasters:

- One firm was outed for delivering “cookie-cutter” pay reports—literally the same recommendations to multiple Fortune 500 clients, with only the logos changed. The price tag? North of $75,000 per report.

- Another recommended a massive equity windfall for a CEO while the company’s stock cratered. Their rationale? “Peer alignment.” Shareholders revolted. The consultant? Promoted internally.

- Several firms claim to be independent while nestled inside global accounting giants. One hand audits, the other consults, the third handles taxes. The CFO writes one check. And independence becomes a farce.

Data Providers: Portals, Paywalls, and “Proprietary” Pandemonium

Executive compensation data providers now wield more power than some regulators. Their portals are the digital Delphic oracles of modern governance—but buyer beware.

- Some firms charge six-figure annual fees just for access. Analysis not included.

- One provider was caught repackaging publicly available data and reselling it at exorbitant rates, dressed up in colorful pie charts.

- Many offer “consulting” services through sister firms—helping clients navigate the very models they keep under lock and algorithm. Sound familiar? ISS, anyone?

Audit and Tax Partners: Double Entry, Double Life

There’s the public accounting firm’s lead partner—smart, slick, and slightly terrified of offending anyone. The audit committee counts on her. The CFO manipulates her. And the board chair thinks she’s the second coming of Alan Greenspan.

Some blur the line between oversight and overbilling:

- A Big Four firm allegedly overlooked material weaknesses at a biotech startup—then helped raise capital off the same books. Their defense? “Interpretive complexity.”

- A tax partner once advised a CEO to structure divorce payments as retention bonuses. It worked—until the SEC noticed.

And then there are the true pros:

- Lynn Turner, former SEC Chief Accountant, whose blunt honesty and forensic mind saved more than one board from itself.

- Jim Doty—former PCAOB chair, whose fearless oversight helped bring teeth to accounting standards.

- Charles Niemeier—whistleblower-turned-regulator and early reform advocate post-Enron.

- Bill Parrett—former Deloitte CEO who maintained ethical clarity in a murky profession.

- Catherine Engelbert—former Deloitte CEO and WNBA Commissioner, praised for integrity, innovation, and steady stewardship.

- Nick Cyprus—respected former audit chair of numerous public companies and longtime voice for audit independence.

- Julie Spellman Sweet—CEO of Accenture with a background in law and auditing, she brought discipline to governance.

- Paul Volcker—yes, the Fed chair, but also a trusted advisor on audit ethics and reform.

- Charles Bowsher—GAO legend who pushed for accountability before it was trendy.

Legal Counsel: The Boardroom’s Better Call Saul

Legal advisors can be the conscience—or the co-conspirators. The best balance fiduciary rigor with savvy risk management. The worst? They’re glorified fixers who make denial look like diligence.

- One GC hid whistleblower complaints from the board, saying it wasn’t “material” unless the media called.

- Another billed 200 hours defending a director who was, at the time, on a two-week yoga retreat in Bali.

The titans?:

- Larry Sonsini—tech law royalty, whisperer to Silicon Valley’s elite.

- Ira Millstein—governance guru and sage of corporate ethics.

- Martin Lipton—Solomon with a law degree, devised the poison pill, saved countless firms from hostile takeovers, and made law firms rich in the process.

- H. Rodgin Cohen—kingmaker of banking M&A and trusted advisor in financial crises.

- Holly Gregory—sharp, insightful, and an architect of modern board best practices.

- Sabastian Niles—trailblazer in shareholder activism defense and strategic governance.

- Richard Climan—M&A maestro and deal whisperer.

- Ann Yerger—former head of CII and leading light on board-shareholder engagement.

Strategy Consultants: McAnswers and Million-Dollar Decks

They show up in tailored blazers, throw around phrases like “core competency convergence,” and drop $300 buzzwords like they’re free mints.

But occasionally, they deliver:

- BCG during GE’s strategic overhaul.

- Ram Charan—boardroom whisperer with real gravitas.

- Jim Collins—if you could reach him.

- Tom Peters—author of In Search of Excellence, an icon of management innovation.

- Rita McGrath—pioneer of strategic inflection points.

- Clay Christensen—the late Harvard professor who practically coined “disruption” and meant it in a good way.

- Gary Hamel—strategy firebrand and vocal critic of corporate inertia.

- Michael Porter—Harvard legend and godfather of competitive strategy.

When they fail? They fail big:

- One top-tier firm advised a legacy media company to invest heavily in NFTs. Within months, the entire division was shuttered. Value left? One set of custom bobbleheads.

- Another pushed a beverage company into AI-enhanced water. Even ChatGPT was confused.

- Let’s not forget “New Coke”—a rebranding misfire blessed by multiple strategic advisors that cost Coca-Cola hundreds of millions and sparked nationwide backlash.

Search Firms: The $300,000 Coin Toss

Executive recruiters are the matchmakers of the C-suite. But when incentives are tied to comp levels, objectivity goes out the window.

- A well-known firm once placed a CEO who had been banned from financial services in the EU. The search consultant said, “We didn’t check that jurisdiction.”

- Another billed a tech company $400K to find a “transformational COO.” He lasted 47 days.

- One PE-backed firm got six figures from two companies in the same month—for the same candidate. They just switched the order of the adjectives.

The real problem? Some search firms recycle their own advisory board members, pushing insiders from their own network. Others charge a fee tied to total comp—so the higher the pay, the higher their payday.

But there are exceptions:

- Spencer Stuart’s elite partners who’ve saved boards from PR disasters.

- Egon Zehnder’s rigorous cultural vetting that’s avoided more flameouts than we’ll ever know.

- Crist|Kolder’s disciplined, data-driven searches with C-suite success rates that put others to shame.

Still, why spend $300,000 on a résumé reshuffler when you could just call Frank Glassner for free?

The Bottom Line

Boards need advisors. But they need the right ones. Not the ones with the best dinner invitations or the shiniest binders—but those with courage, clarity, and a spine made of steel.

Because if your advisor’s most valuable contribution is helping the CEO pick a new private chef? You’re not getting advice. You’re getting fleeced.

Chapter X: What Would Frank Do? — How to Build the Empire Right

Let’s face it. We’ve just spent nine chapters parading out the good, the bad, and the utterly deranged in today’s boardrooms. If you’ve made it this far without reaching for your defibrillator or your lawyer, congratulations. But now comes the moment of truth.

If you’re a board chair, a lead director, a CEO with a conscience (yes, they exist), or even an aspiring whistleblower with a flair for governance, this is your manual. This is how we build the empire right.

Want a board that doesn’t land on CNBC in handcuffs? Start here:

- Ban “CEO’s best friend” appointments.

- Recruit for skill, courage, and curiosity.

- Tie pay to outcomes, not “effort.”

- Use real dashboards. Show real KPIs. Reward real impact.

- Make meetings shorter. Make decisions faster. Make excuses extinct.

- Eliminate the sacred cows and severance landmines.

- Rotate committee chairs regularly—power should never get too comfortable.

- Interrogate performance metrics like they owe you money (they do).

- Refuse to approve comp plans you don’t understand.

- Invite dissent. If everyone agrees, no one’s thinking.

- Rehearse the crisis before it arrives—because it will.

- Never be the last to know. That means walking the halls and listening to whispers.

- Read the damn filings. All of them.

- Don’t let strategy consultants outnumber executives in a room—unless your strategy is to lose money.

What Would Frank Do?

He’d stroll in, nod to the general counsel, and drop those four words that bring fear to unprepared execs everywhere:

“Help me to understand.”

And then he’d start asking questions—pointed, uncomfortable, and necessary:

To the Audit Committee:

- When was the last time internal controls were truly stress-tested?

- Why did the auditors miss the red flags in footnote 17?

- Why is the corporate jet showing five stops in Napa last quarter?

To the Compensation Committee:

- Why did the CEO receive 3x target bonus with negative TSR?

- What’s the justification for approving a retention grant during an earnings restatement?

- Would you defend this plan live on CNBC with a straight face?

To the Nominating & Governance Committee:

- Are we really independent—or just golf buddies with a good shrimp tower?

- Why are there no directors under 50 or over 75?

- Would you swap seats with a public-school principal or ICU director for a month?

To the CHRO:

- What are you doing about leadership development—besides ordering another engagement survey?

- Why does our succession plan read like it was drafted in crayon by consultants in 2009?

To the CEO and CFO:

- Can you explain the business model without jargon?

- Why did capex double in Q4 with no explanation?

- Are you hiding something, or just confused?

To Legal Counsel:

- Would this board’s independence hold up in Delaware Chancery Court—tomorrow morning?

- Have you reviewed all interlocks, family ties, and “casual relationships” recently?

To Outside Advisors:

- Strategy consultant: why is there not a single operator on your team?

- Executive search firm: did you disclose all red flags, or just the ones that didn’t kill your fee?

- Data provider: defend your peer group picks—like you mean it.

And then, as always, he’d close with the one-liner that no one wants to hear but everyone needs to:

“If you can’t defend it on CNBC, don’t vote for it here.”

The Bottom Line

Boards don’t need another vision statement. They need vision. And courage. And advisors who aren’t afraid to get their hands dirty. Because real governance isn’t about appearances. It’s about accountability.

This isn’t just about fixing the empire. It’s about building it right—from the foundation to the C-suite, from the bylaws to the bonus plans.

So... shall we build it right?

Because if you don’t, someone else will. Likely with a subpoena.

Chapter XI: The Veritas Way — Boards Built for Truth

If "What Would Frank Do?" is the strike of lightning, The Veritas Way is the thunder that follows. It’s the roadmap to not just surviving the white-hot spotlight—but shining under it.

This chapter is about what happens when boards actually live the principles they plaster on the lobby wall. It’s not a theory. It’s a blueprint—tested, scarred, and fine-tuned across decades of boardrooms, bailouts, and backchannel brawls.

Rule #1: Governance Without Fear or Favor

The Veritas Way begins with loyalty—to the mission, not the monarch. Directors are fiduciaries, not fawning entourage. If you’re afraid to ask a question because the CEO might frown, you’re in the wrong seat—or worse, you’re the problem.

Rule #2: Pay for Performance, Not Proximity

No more shell games. If the CEO’s pay goes up, show us the value returned. Not effort. Not charisma. Results. Bonus plans should be earned, not inherited. Equity awards? Vest them when real milestones are hit. And if the stock drops 40%? We don’t need a consultant to explain why the LTI plan needs a "rethink."

Rule #3: Dashboards That Aren’t Designed by Magicians

The Veritas dashboard is brutal. Simple. Transparent. It doesn’t reward sleight of hand or creative accounting. It shows what matters: growth, return, people, innovation, reputation, and risk. If you need three footnotes to explain it, you’re doing it wrong.

Rule #4: Committees That Actually Commit

Audit, Comp, NomGov, Risk, Tech, ESG—they all exist for a reason. Under the Veritas model, each has a mandate, a charter, and real teeth. Rubber stamps get shredded. The Executive Committee? It isn’t a secret power cabal. It’s a deployment squad.

Rule #5: The “Right” People, Not the Right People™

We don’t need another credentialed mannequin. Veritas boards are built with intelligence, not status. The best director might not have three MBAs—but they know how to read a balance sheet, question a narrative, and call bullshit with a velvet glove.

Rule #6: The CHRO Has a Voice

Talent isn’t an HR issue. It’s the issue. Veritas boards insist that the CHRO isn’t just invited to the meeting—they’re heard. They talk succession like it matters. Because it does.

Rule #7: Succession Isn’t a Last-Minute Fire Drill

The Veritas board has an emergency succession plan for the CEO, CFO, General Counsel, and CHRO. Not just on paper—but practiced. Because leadership failure isn’t an "if." It’s a "when."

Rule #8: The Annual Offsite Doesn’t Involve Parasailing

Veritas boards travel light. No $4,000 bottles of wine. No sandbar strategic sessions with CEOs talking about synergy in flip-flops. If you want a retreat, go to therapy. If you want results, get to work.

Rule #9: Transparency Isn’t Optional

Every policy, every perk, every grant—defensible in daylight or don’t do it. Want to pay your CEO $30 million? Go ahead. Just be prepared to explain it to your employees, your investors, your grandkids... and the front page of the Journal.

Rule #10: Self-Evaluation That Doesn’t Feel Like a Group Hug

Veritas boards evaluate themselves brutally and honestly. Dead weight is rotated off. Blind spots are filled. If your board evaluation reads like a yearbook message, it’s worthless.

The Veritas Test

Ask this about every major decision:

Would we do this if no one were watching?

And then ask:

Would we do this if everyone were?

If the answer isn’t the same both times, go back and try again.

Final Thought

Veritas doesn’t mean perfect It means truth. It means honest. It means accountable. It means brave.

Because when the subpoena comes—or the front page hits—you don’t want to be the director who has to say:

"I just signed what they gave me."

Build the empire right. The Veritas Way.

Epilogue: The Long Walk Off the Short Pier

Let’s be honest: if you made it this far, you’re either a glutton for punishment or you see the boardroom for what it really is—a cocktail of power, pressure, pretense... and, if we’re lucky, purpose.

But too many boards are still playing dress-up—parading around in bespoke suits and bespoke ethics, raising glasses to ESG while torching the foundations of trust. They pose for diversity photos while whispering backroom deals, talk transparency with all the clarity of a fog machine, and approve pay packages that would make Caligula blush.

This isn’t governance. This is performance art.

We’ve watched chairs fall asleep, compensation committee members who needed a dictionary to define "TSR," and audit committees who think footnotes are decorative. We’ve seen the same search firm place the same recycled CEO five times in a row like it’s a game of corporate musical chairs. And let’s not forget the retreat in Jackson Hole—where governance reform took a backseat to foie gras and fly fishing.

The truth? The empire has cracks. And termites. And a very expensive scent diffuser trying to mask the rot.

So here’s the gut punch:

If you’re sitting on a board and you can’t remember the last time you asked a hard question, challenged a sacred cow, or made a decision that made you sweat—resign. Today. Give the seat to someone who doesn’t need the LinkedIn headline or the Ritz-Carlton perks.

And if you’re a shareholder, employee, or just someone with a pension invested in this circus, stop treating governance like it’s someone else’s problem. Demand better. Vote better. Speak up. Because silence is the seatbelt in the back of the clown car.

Here’s the laugh-through-the-tears truth: most of this can be fixed. With backbone. With candor. With just one director standing up and saying, "Enough."

You don’t need a revolution. You need one brave person in the boardroom to light the match. And if you're not sure who that is... check your seat.

Because the real empire—the one built on trust, truth, and guts—starts there.

Right. Where. You. Sit.

Now put the shrimp cocktail down, pick up the 10-K, and let’s go to war.

FBG

**********************************************************************

PS: If this piece made you laugh, nod in agreement, or mutter “he’s talking about me behind my back, isn’t he?”—I’d love to hear from you. Drop me a line at fglassner@veritasecc.com. I personally read and reply to every message—no assistants, no AI, just me (usually with a strong espresso in hand). Whether you’re a board member, CEO, CFO, burned-out executive, investment banker, activist shareholder, client, consultant, lawyer, accountant, ex-wife, one of my beloved twin sons, AI Bot, or just a fellow traveler in the great corporate circus, I welcome the conversation.

Thanks!

**********************************************************************

Frank Glassner is the CEO of Veritas Executive Compensation Consultants and a widely respected authority on executive pay and strategic compensation design. Known for his discerning judgment, consummate diplomacy, incisive insights, and unwavering discretion, he is a trusted advisor and confidant to boards, CEOs, and institutional investors worldwide.